Is there a relationship between Uranium and Gold?

Here is a different look at how Uranium and Gold are related. Tom McClellan outlines his thoughts on this relationship and where he thinks it could lead prices.

I highly recommend visiting Tom’s site for other great commentary – Click here to visit.

Tom McClellan Uranium and Gold, Part II

Last week, I wrote about the relationship between gold prices and uranium prices, and how looking at it a certain way there might be a bearish message for uranium prices. I received a few emails, first notifying me that you actually can trade uranium on the Toronto exchange, under the symbol U.TO. That is for the Uranium Participation Corp, which invests directly in uranium oxides. It is like CEF or GLD for gold bullion, only for uranium.

But a much more interesting message came from a longtime reader who is a financial advisor in Alberta who has a lot of experience investing in uranium related businesses, and who prefers to remain anonymous for these purposes. He offered that I might have been looking at the relationship between gold and uranium in the wrong way, and that instead there might be a leading indication relationship there.

That intrigued me, and so I started looking at the data again. That led to this week’s chart, which reveals that the gentleman from Alberta might be onto something. For the record, he had never thought to look at the two items together before either, but he has seen enough of the Liquidity Wave relationships that I talk so much about that he has learned to look for these leading indication relationships.

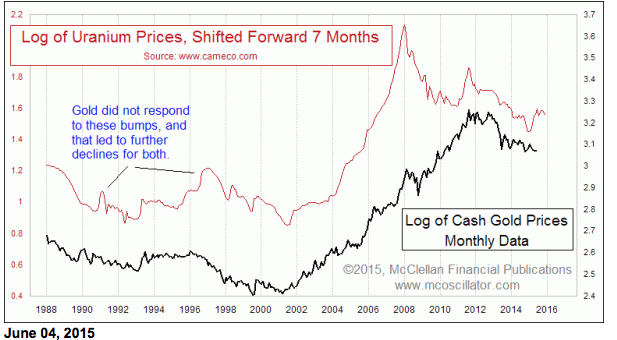

When I adjusted by shifting the uranium price plot forward, the real relationship became more clear. It took some tweaking, but a forward offset of 7 months brought the best correlation between the two price plots. It is still not perfect, and uranium prices do not explain all of the movements of gold prices, but it is nevertheless a really interesting correlation.

The implication is that one can watch what uranium prices do and thereby get an indication of what gold prices are going to do up to 7 months later. Such relationships are really fun to find. I like getting the answers ahead of time.

So far, gold prices (in dollars) have not yet responded to the mini-rally in uranium prices which occurred in late 2014. So the message from uranium is that there should be an upside bias for gold prices. And if the forecasts are correct about rising uranium demand for new nuke plants in China and India, not to mention Japan bringing its own nuke plants back online, then that should mean continued upward pressure on gold prices in the years ahead.

But we have seen instances as highlighted in the chart when uranium prices zigged upward, and gold did not follow suit. Each of those led to a further decline for both uranium and gold prices.

Tom McClellan

The McClellan Market Report

www.mcoscillator.com

Shad:

When the bull market in resources started around 2000 resources were dirt cheap.

Very few were mining because it wasn’t economical..Then prices rose the boom was on the economy was roaring everywhere and the rush to mine was on. Speculators rolled in along with the scammers. The economy and speculation peaked and blew up. The under-supply became oversupply as demand was disappearing. Thats the cycle and when it ends its DONE for a long time….Nothing with bring oil or da gold boom back to that level to soon.

Here’s an OLD piece but he makes most look like idiots. Hes not short now but there is NO LARGE DEMAND now. Supply is still pumping so good luck with your call.

http://www.bnn.ca/News/2013/12/6/Why-JF-Tardif-is-shorting-Canada-and-commodities.aspx

Here is a detailed report of all commodities by the World Bank in April of 2015, and it does show commodities bottoming in 2015, but that there is still a healthy and growing demand. There’s a big world developing out there Bill beyond just the US, Canada, Europe, Japan, and China. There is Indonesia, Thailand, Cambodia, Vietnam, S. Korea, Russia, the ex-soviet territories (the stans….), the Middle East, Mexico, Central Amercia, South America, and Africa.

How do you propose they get cars, laptops, iphones, and appliances with out the resource sector? How will they power things without oil, nat gas, uranium, and lithium batteries? With solar? With wind? How do you build solar pannels again…..oh yeah, with commodities. How do you build windmills again…..oh yeah, that’s right, with commodities.

http://www.worldbank.org/content/dam/Worldbank/GEP/GEPcommodities/GEP2015b_commodity_Apr2015.pdf

To be clear (since I know you are an avid fan of AVA Research)……

I’m not a gold bug, and I’m not an economic guru worshiper. I don’t have any paid subscriptions to newsletter writers, and listen to as many points of view as possible.

I’ve never called for a bottom in the resource sector in 2011, 2012, 2013, or 2014, because it was clear to me that they were heading lower. Towards the end of 2014 and beginning of 2015 I was clear that the technical and fundamental data pointed to a end of the 4 year bear in PMs and the 7 year CRB commodity index in the 2nd half of 2015 in the late summer (July/August).

The reasoning behind this bottoming in the next few months will be confirmed based on the turbulence we see in currency markets, the bond market action as of late, and a general stock market that is about to have its pants pulled down and spanked in September.

As a result, commodities will pick up some of the money flow out of certain currencies, bonds, and failing equities over the balance of this year, ending the bear, and starting a new bull. I am not a too the moon guy, but I’m also not a dummy, see a new macro trend setting up is all.

Good points but I’m on the run. I’ll get back.

The world has always been growing shad. When the population was half there were cycles that went up and down. That was with way less demand. Way less consumption. So why the bear market decline then Shad? It should just go straight up?! The world bank isn’t my source for investing that’s for sure. We could be flat or a trading range for years. This is typically the consumer investment cycle period.

PS I have worked building Cellular networks since 1990. I deployed every technology there is. Do you have any idea how the reduced Consuption of materials in this field. It is 10% of the metals used to do the same job as 15 years ago. Its unbelievable. I could go on but since the economy is so crappy as some say I’ve got to get back to work. $12k in 3 days in the field. Piss poor economy. Lol

Bill, I think you are an intelligent guy, and you raise some good points, and you are right to be skeptical of the “gurus” so many chase that have been dead wrong the last few years.

Having said that this statement was a departure from your normal intelligence.

” So why the bear market decline then Shad? It should just go straight up?!”

If you understand anything about commodity cycles, or any asset class, then nothing goes straight up. Period.

There are bear markets and bull markets. Always have been.

We are ending a 7 year cyclical bear market in commodities within a 30-50 year secular bull in commodities. If you have the foresight of a longer time horizon, and an understanding of the result of the global central banks money printing longer term, then the commodities graph will most assuredly be pointed up and to the right, but it will be a series of ups and downs – not straight up.

Again, I’m not a gold pumper, or fanatic. My biggest positions are in Uranium, Palladium, Zinc, Copper, Tin, Fertilizers, and Lithium, with a healthy interest in Silver and Gold miners (but not until we have the washout this year). I have gone to the sidelines in oil until I see the pullback I expect is coming and then I’ll be moving back into the sector once the dust settles.

BTW – I agree with you that due to innovation, re-engineering, and a recycling of components, that technology is making strides to reduce consumption, but stuff still needs to be pulled out of the ground to make everything in the modern world.

The phone or computers we are using to have this conversation, the planes, trains, and automobiles you use to get to the Cellular towers, the tools you use, the satellites that bounce the signal, the stores that sell customers their smart phones, and the energy that powers all of this is dug out of the ground and fueled by commodities. As the rest of the world follows suit, they’ll need commodities and energy.

All I’m saying is that the 7 year CRB bear pattern is getting close to bottoming, and we are at a turning point in commodities (as a sector with many moving parts) later this year. I don’t think that is a very controversial statement.

The thing that boggles my mind is that so many standing around for year staring at a dead bull and talking about it while other markets have soared.

Actually the economy is muddling along. Some select sector are flying like mine. BUT until there is another global boom good luck with commodities. The cycles aren’t exact or everyone would be rich!

I invest in more than just commodities, and also like the energy space, agriculture, real estate, and have boring retirement account tied up in Blue Chips, defensive Utilities and dividend paying stocks, financial companies, tech companies, healthcare, emerging markets, and some corporate bonds.

However, for my trading account, I like going where there is no love. That is why I have a larger position in Uranium miners (which is hated) more so than even the gold and silver miners. There are great plays setting up in Fertilizers, Lithium, base metals like Copper, Zinc, and Tin, and even the specialty metals.

I do agree that cycles are not perfect and it may not be exactly 7 years and the bear in Gold may be more than 4 years. You are correct that nobody knows, but the recent gyrations in the currency markets and bond markets and trepidation in stock market should be telling he that has the eyes to see and the ears to hear, that something is building and is going to break out in the next few months on a global scale.

The 30 year Bond party is coming to a close, and there will likely be a blow-off top in the US equities and Chinese equities, and Canadian real estate market, and a last hoorah in bio-tech and the high flying social media stocks…..but their days are numbered.

Money will be leaving those sectors and need a place to go, and commodities have historically done well when money leaves the stock markets and inflation starts to rear it’s head with interest rate increases. I’d rather be a little early to the party later this year, and if it takes until 2016 to really get going then who cares?

I normally don’t hold equities for long periods, but this will be an exception period where quality names are so trashed right now, that I’ll be taking longer term positions to hold for years over the next 3-6 months.

I wish you well, but just like the Gold bugs were wrong in 2011, 2012, 2013, 2014 and thus far in 2015, on a turnaround; then likewise, the Gold Bears will be wrong in 2016, 2017, and 2018….. Again, Gold is just one asset, and I am interested in how the entire commodity complex will be rising for years to come.

Dang, talk about being Abbi Gilbert bullish

http://www.marketwatch.com/story/the-next-great-bull-market-gold-25000-2015-06-04

Yes, that’s “Abbi” Gilbert bullish…to the moon.

NICE INDIAN WOMAN and GOLD !!!!! The more the dollar UP the more your FULL off ? POWER-TRIPPING ! https://www.youtube.com/watch?v=sUr2E4dfs0Y You now the ????

JADE…… funny……

I forgot about that. Hilarious!

franky……….nice post……….

LOOK OUT BELOW………….

HA………JOB NUMBERS………..288K hamburger flippers needed in Simi Valley to pick grapes before harvest rot…….or before the water is shut off…….. 🙂

HEALTH CARE……..408,000 JOBS ADDED this year…..up this month 47,000…..Baby boomer sickness………construction up, building healthcare centers and old age communities……..

Wind energy vs. fossil fuels: Hurdles and hopes for a renewable future

the only RENEWABLE NEEDED………….IS THE MIND……….. 🙂

The Saudies are going to pump and pump and pump………oil is going down, and so are the frackers…………..1970 all over again……….except in reverse,,,,no shortage, or oil lines.

it is a frack job……….NWO….equal NEW WORLD OIL…glut……………

New World Oil……. good one.

Now a 3rd merger in the Uranium space announced in the last few months. Why would 3 different larger players in Uranium all go shopping at once if they didn’t feel now was the time to position for long-term growth in the Uranium sector?

MERGER OF URANIUM RESOURCES, INC (NASDAQ:URRE) & ANATOLIA ENERGY LIMITED (ASX:AEK)

On June 2, 2015 at 7:06 am,

Shad says:

….I am excited that I hold a small position in Anthem Resources Inc. However, I’ll admit I got it backwards and anticipated it was Anthem who would takeover Boss Power. It’s the other way around and Boss Power is taking out Anthem Resources.

Either way, I’m thrilled because I’ve been building a position in them this year, and was following their press releases and the new agreements and earn-in percentages on their Joint Ventures, and Anthem’s increased stake in Boss Power.

Anthem Resources Announces Definitive Arrangement Agreement With Boss Power

June 02, 2015

On May 12, 2015 at 5:56 am,

Shad says:

“…..Of course the biggest profits will be in having good positions built in the speculative explorers that will be taken over by the majors like Fission, UEX Corp, Toro Energy, Kivalliq, Canalaska, Anfield Resources, Bayswater, Anthem, Laramide, Strateco, Forum, Berkley, Purepoint, Aldrin, and Peninsula Energy.”

On June 2, 2015 at 7:46 am,

Shad says:

Just for clarity, I expected to Anthem to be taken out as noted earlier this month, but I still expected Anthem to take out Boss Power before being taken over. It turns out Anthem did get taken over so regardless, the consolidation in the Uranium space is heating up, with another merger I am part of, the Uranerz takeover by Energy Fuels (I have shares in both and think this is a particularly strong merger that has not been fully recognized by the marketplace).

Good luck to all in their investing!

I am in agreement that in the commodity marketplace Uranium is often the early mover ahead of PMs and base metals. However, in this case I think the majority of the bottom is in for Uranium, and I’m still of the opinion that Gold has a date with lower lows. This is all relative to the spot prices of course, the miners are a different animal.

For the Uranium miners, I have been building large positions over the last year, and in particular the last 6 months. I see their returns over the next 2-3 years as being stellar. In contrast, I have built some positions in quality PM producers, and exploration takeover targets, but I’m back to only 20% overall position.

Conclusion – I expect select Uranium miners to continue moving up in the summer while with even the PM miners I like, there is the potential of lower prices over the next 2-3 months. Most commodities have shown some strength at the end of 2014 and first half of 2015, but we’ve entered the window of time where the major bottom will likely play out. No way of knowing, and things can get delayed until fall, but the end of the 4 year PM bear and 7 year commodity bottom are upon us.